Micro, Small, and Medium Enterprises (MSMEs) play a key role in driving economic growth, creating employment opportunities, and fostering industrial development. However, MSMEs often encounter problems like difficulty in obtaining loans, complex paperwork for licenses and permits, and delays in payments for their goods and services. Recognizing this problem, the Government of India introduced the Udyam registration process in July 2020 to streamline access to benefits and support mechanisms for MSMEs.

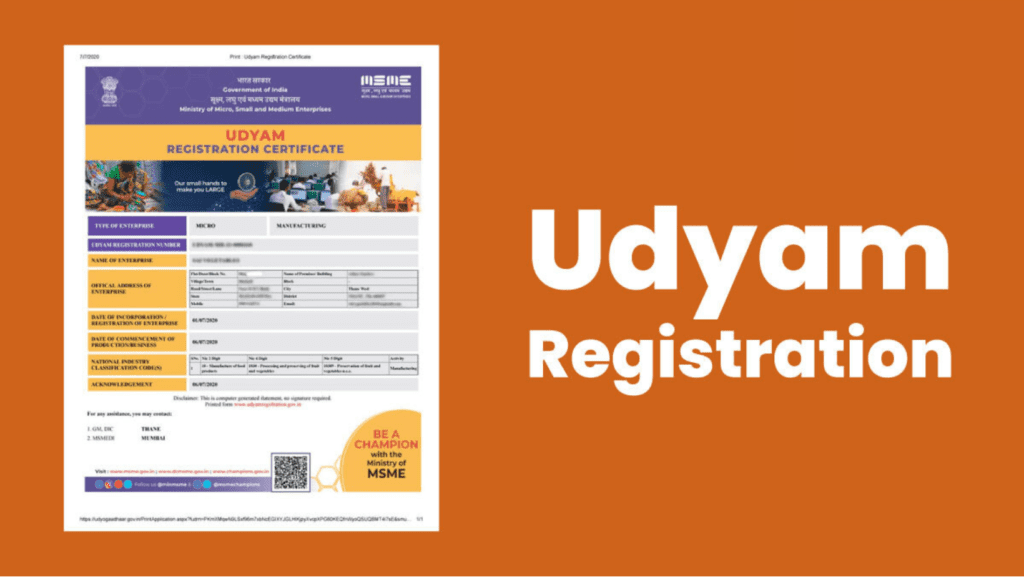

By obtaining this certification through the official government portal, MSMEs receive a unique twelve-digit Udyam registration number (URN). This certification helps MSMEs to receive a number of benefits. These benefits include access to collateral-free loans from banks and financial institutions at reduced interest rates. The registration also streamlines the process for obtaining licenses, permits, registrations, and approvals.

Moreover, MSMEs can have discounts of up to 50% on trademark and patent registration fees, as well as reimbursement of ISO certification fees. They are also exempted from government security deposits when bidding for tenders and are eligible for tax exemptions. Additionally, Udyam registration provides concessions on water and electricity bills. Importantly, it safeguards MSMEs against delayed payments for goods or services provided.

Documents Required For Udyam Registration

The Udyam Aadhaar registration is done completely online, without needing any paper documents. Since it is based on what you declare yourself, there is no need to provide any proof when registering your MSME. All you need is the Aadhaar number of the owner or authorized signatory of the business.

You also must have a PAN and GSTIN to get the Udyam Aadhaar certificate. Additionally, you will also need some basic information like proof of your business address, which can be shown through property tax receipts or utility bills (like telephone or electricity bills). Moreover, you will need to provide your bank account details.

Steps to Register an MSME for Udyam registration

Step 1: To register on udyamregistration.gov.in, choose ‘For new entrepreneurs who are not registered yet as MSME’. If you have already registered under UAM and want to switch, click ‘For those already having registration as UAM’.

Step 2: Enter your Aadhaar number and name, then click to validate and generate OTP for verification. For a proprietorship firm, use the proprietor’s Aadhaar; for a partnership, use the managing partner’s Aadhaar; for a Hindu Undivided Family (HUF), use the karta’s Aadhaar.

Step 3: If it is a limited liability partnership, cooperative society, society, or trust, provide the organization’s GSTIN, PAN, and Aadhaar.

Step 4: After validation, choose your organization’s type (like proprietary, partnership, LLP, or private limited company) from the dropdown menu, and enter your PAN for verification.

Step 5: Fill in details like enterprise name, location, office address, bank details, business type (manufacturing or service), NIC code, and employee strength.

Step 6: You can also opt for auto-registration on portals such as Government e-Marketplace (GeM), TReDS, National Career Service, and the B2B portal of the National Small Industries Corporation (NSIC) at the same time.

Step 7: You can add multiple activities in both manufacturing and service under a single Udyam registration. No need for multiple certificates. Click ‘Submit and Get Final OTP’.

Step 8: After successful registration, you’ll receive a ‘Thank You’ message on your mobile and email with your Udyam registration number. The certificate with a QR Code will be sent over email. There’s no need to renew it annually.

Step 9: To print the original certificate, go to the ‘Print/Verify’ tab on the Udyam portal, click ‘Print Udyam Certificate’, enter your Udyam and mobile number, and generate OTP. After login, you can print the certificate.

Step 10: To verify the Udyam number, go to the ‘Print/Verify’ tab, click ‘Verify Udyam Registration Number’, enter the registration number and captcha, then click Verify.