On the eve of International Women’s Day, the Mumbai-based SEBI registered venture capital management company, Colossa Ventures led by Ashu Suyash and Vandana Rajadhyaksha, has declared the first close of its maiden fund – the Colossa WomenFirst Fund, securing INR 100 Crore.

Founded by Ashu Suyash, the former MD & CEO of CRISIL and former India Country Head at Fidelity International, alongside Vandana Rajadhyaksha, the Ex-Partner at ICICI Ventures and Aditya Birla Private Equity, Colossa Ventures aims to tap into the potential of India’s female-driven economy, important for India’s journey to a USD 10 trillion economy by 2035.

Shri S.P. Singh, Chief General Manager Incharge Venture Finance & Investment Vertical SIDBI said, “With Women’s contribution to GDP expected to register strong growth in the coming years our organization is looking to back exceptional women founders who can contribute to building a sustainable and inclusive future. We believe that the Colossa team is well placed to do so and we are proud to invest in the Colossa WomenFirst fund.”

What sets the Colossa WomenFirst Fund apart is its approach of leveraging gender diversity to generate alpha, gathering interest from notable institutions like SIDBI and family offices including Dr. Ranjan Pai’s Family Office and the Shriram Ownership Trust.

The fund aims to transform the startup landscape by focusing on high-quality “WomenFirst” businesses. These are startups that are either founded or co-founded by women, or where women are the main beneficiaries of the business model. With a target corpus of INR 500 Crore, the Colossa WomenFirst Fund is set to fund the ventures at the Pre-Series A stage and beyond in sectors such as Healthcare and HealthTech, FinTech, Climate & Clean-Tech, Deep Tech, and the Consumer sector.

Dr. Ranjan Pai, Chairman, Manipal Education and Medical Group (MEMG) said, ” Colossa’s vision resonates with our commitment to fostering long-term growth by powering underrepresented entrepreneurs in India. As women increasingly take the lead in building substantial businesses, we see our participation in Colossa WomenFirst Fund as strategic deployment of ‘confidence capital’ to fuel the growth of women entrepreneurs.”

About Colossa Ventures: Empowering Women-Led Businesses

Colossa Ventures is an Indian Alternative Investment Fund approved by SEBI (Securities Exchange Board of India) in 2023 and is dedicated to supporting the growth opportunities for women in India. As an Indian venture growth fund, Colossa Ventures focuses on “WomenFirst” Businesses and aims to leverage gender diversity to generate alpha for investors while empowering women entrepreneurs.

Vandana Rajadhyaksha, Co-Founder of Colossa, added, ” Women are at an inflection point of the Indian economy and the next decade is going to be owned by women entrepreneurs. We see this as an opportunity to build a unique portfolio catalyzing strong financial performance.”

Colossa Ventures aims to empower women entrepreneurs with its 3C framework: Capital, Capability, and Confidence, and through investments and support, the fund aims to fast-track high-potential women-led ventures. By providing the necessary financial backing, expertise, and mentorship, the fund focuses on unlocking the full potential of women entrepreneurs.

Mr. D V Ravi, Managing Trustee, Shriram Ownership Trust said, “Since inception Shriram has been dedicated to fostering growth in the MSME segment in India. We are committed to unlocking the potential of growing businesses and are pleased to contribute to the Colossa WomenFirst fund to scale women-led businesses and further our mission.”

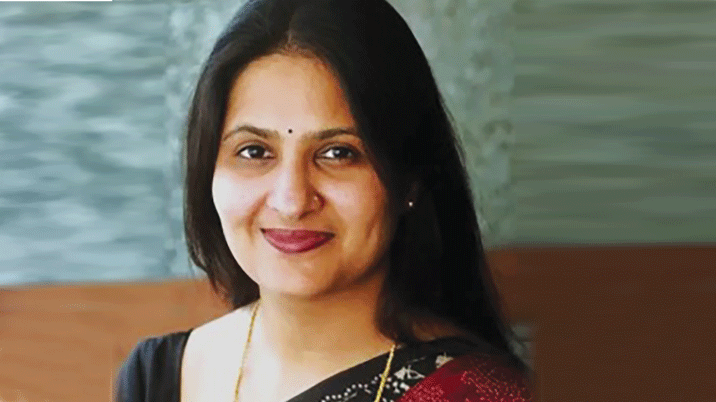

Ashu Suyash- The Woman Behind Colossa Ventures

Ashu Suyash started her career at Citigroup India after finishing her bachelor’s degree at Narsee Monjee College of Commerce & Economics and the University of Mumbai. She spent 15 years there, gaining valuable experience in different important roles. While at Citigroup, Suyash learned about operations, investment banking, finance, sales, marketing, and general management, giving her a good grasp of the financial sector.

In 2005, Suyash became the managing director and country head of Fidelity Worldwide Investment’s India operations, leading the growth of the asset management business, especially in the equity fund segment, which made up 80% of the portfolio. Her unique business strategies helped Fidelity succeed and established her as a standout leader in the financial sector.

In 2012, Suyash took a big step in her career after Larsen & Toubro Ltd acquired Fidelity’s India asset management business for ₹550 crore. She became the CEO of L&T Investment Management, where she managed a variety of mutual fund schemes and helped in a significant increase in assets under management.

In 2015, Suyash transitioned to the role as the Managing Director and Chief Executive Officer of CRISIL Limited, where she helped establish it as a trusted and innovative leader in the data analytics and financial services industry. In 2022, Suyash started her own investment firm, leading to the foundation of Colossa Ventures where she used her experience to create opportunities for women in India.

Currently, apart from her role as the Founder & CEO of Colossa Ventures, Ms. Suyash serves on the board of Hindustan Unilever Ltd., one of India’s leading consumer goods companies, as well as Kotak Mahindra Bank Ltd. Additionally, she is a board member of the National Institute of Securities Markets and a Member of the Corporate Governance Council at the Confederation of Indian Industry (CII).

Ashu Suyash, Founder & CEO of Colossa. “Colossa’s mission is to unlock the great potential of India’s trillion-dollar women economy that is not just under penetrated, but underinvested in, and underestimated. It seeks to do so by identifying, backing, and fast-tracking highpotential Women entrepreneurs building disruptive businesses through powering them with Colossa’s proprietary 3C framework: Capital, Capability, and Confidence.”

Join The Story Watch’s initiative to create a vibrant community for the startup ecosystem.