Zerodha, the barrier-free brokerage firm founded by brothers Nithin and Nikhil Kamath, recently overthrew ICICI Securities to become the largest brokerage firm in India. Since passing ICICI Securities in 2019, Zerodha has secured itself in the top spot accounting for nearly 19% of the market share at the time of writing.

Being India’s first discount brokerage company, Zerodha has achieved it’s substantial growth by spearheading technological innovation and providing quality customer service. Zerodha’s disruptive pricing models and technological assets have been key in their rise among the competition.

Foundations of Zerodha

Zerodha started small, with a team of just five people back in 2010. Nikhil and Nithin co-founded Zerodha deriving the name as a portmanteau of the number ‘Zero’ and the Sanskrit word ‘Rodha’, which means barriers or obstructions. Launching as a discount brokerage, the first of its kind in India, Zerodha was capable of offering lower costs to customers. Cost-saving measures were taken by not providing full-fledged research and consultation amenities to customers, which is the major differentiation between discount and full-service brokers.

Additionally, Zerodha applied a flat Rs. 20 fee on every trade, regardless of transaction value. In contrast to most major brokers, Zerodha also did not charge a brokerage fee; a decision considered to be quite disruptive to the market by experts at the time. The lower fees, unexpectedly, proved to be a hindrance in the initial launch phases with Zerodha recording only 3000 accounts opened in the first year of operations. Nithin Kamath attributed this slow start to the public mindset prevalent which led people to associate the price of the service offered with the quality expected.

“When the cost of any product or service is less, people automatically question the quality. That was a big challenge for us right from the start. We were able to build a community around us, which helped in the long run. Even today we don’t spend any money on advertising” says Nithin

Community-based growth

The strategy of building a user community boosted Zerodha’s growth enormously as it gave customers the opportunity to interact with each other. Thus, the skepticism towards the discount model introduced by Zerodha gradually dissipated as more and more customers entered the picture. The problem with discount brokers, lack of research services and advice, still remained and was an evident shortcoming in Zerodha’s system.

To counter this issue, Zerodha introduced Varsity. Designed as a training module, Varsity addressed the lack of research and analysis by providing an extensive collection of stock market and financial lessons to customers. Furthermore, they run an active forum ‘Trading Q&A’ to provide a platform to both traders and investors alike, giving them the opportunity to interact and discuss ideas with each other. To top things off, Zerodha makes frequent posts to their interactive blog ‘Z Connect’ so that all their customers can remain up-to-date with the changes and advancements taking place in the industry.

“The problem we are trying to solve with this is how to grow the capital market ecosystem in India. It can only happen through educating people on a platform which has content and engagement both,” Nithin said

Focus on Technology

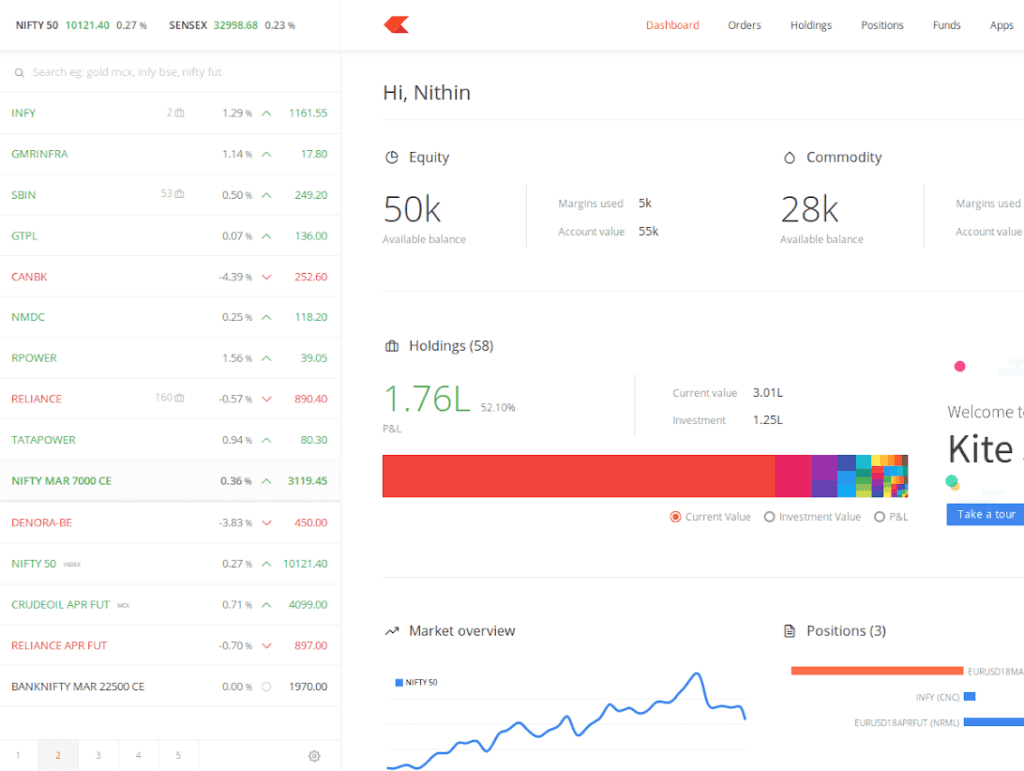

In the early 2010s, although Zerodha had amassed a substantial userbase, they still remained relatively unknown. With the e-commerce sector gaining traction and issues with the sluggish, legacy user platforms getting more and more unfeasible; Zerodha looked to innovate again. This led to the formation of Zerodha Technologies in 2013, followed by the development and release of their flagship trading platform ‘Kite’. Kite revolutionized the way users interacted with the platform. It was a breath of fresh air that looked and felt remarkably different from the competition. Zerodha took the risk of completely redesigned their interface, and it paid off incredibly with their userbase showing enormous growth.

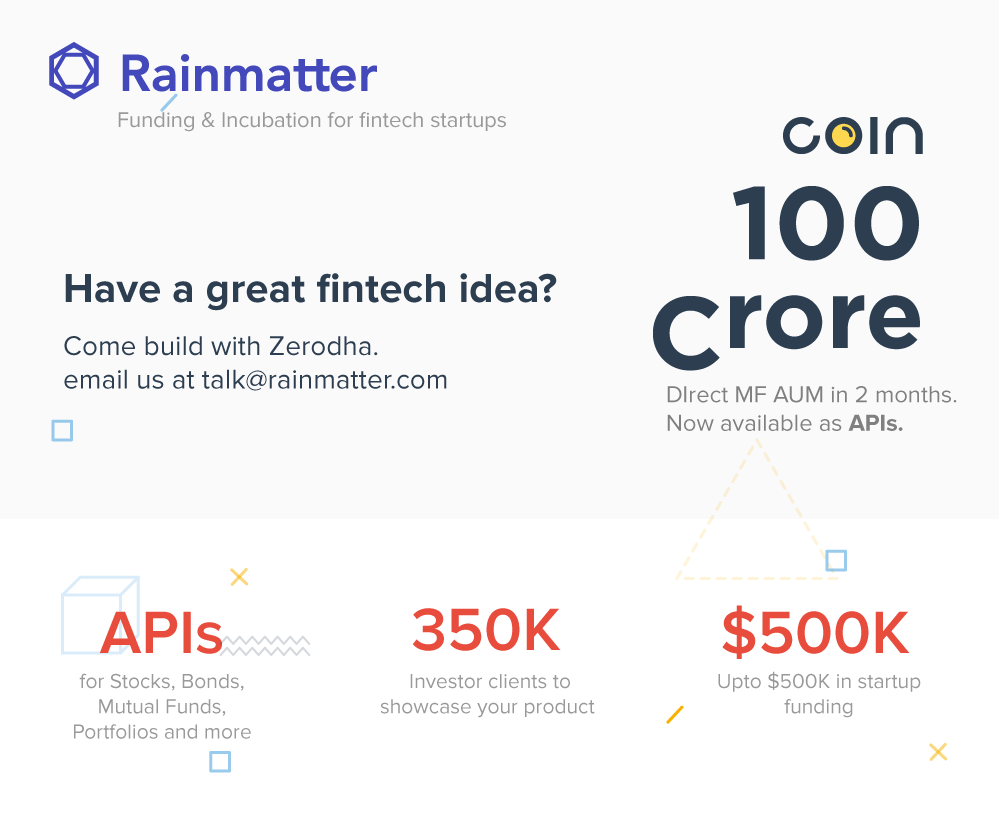

The launch of Zerodha Technologies was symbolic of Zerodha’s desire to spearhead technological innovation in the financial sector. Developing their own in-house R&D division, design teams and software development section; Zerodha has gradually established itself as a FinTech giant in the industry. They’ve built a developer ecosystem that encourages innovation by opening up the broker ecosystem through their APIs, thus, allowing developers to work on new technologies over Zerodha’s pre-existing infrastructure. This has drastically reduced the previously present licensing barriers and reduced the time taken for releasing fresh technology.

Start-ups with potentially ground-breaking ideas can further take advantage of Rainmatter, a FinTech start-up incubator launched by Zerodha in 2014. They have previously funded several start-ups including the likes of Smallcase, Finception and Sensibull. Rainmatter also helps start-ups form connections in the industry and assists them in forming strategic partnerships.

Future Scope

Zerodha’s success so far is unsurprising, given their desire to always lead the pack. First to introduce the discount brokerage system. A pioneer in the e-commerce boom. A consistent FinTech advocate supporting several start-ups, encouraging new ideas and innovation. Zerodha has never been one to shy away from taking a risk, using cutting-edge technology to push their boundaries.

The fact the Zerodha has zero advertising expense and still have the growth numbers that they do, is only tangible proof that they must be doing something right. The company has shown a 15% growth in value over the course of FY 19-20 and show no signs of stopping anytime soon.

“India is very dependent on foreign capital to drive the country. For any country to do well, you need local residents to put their money in the market. The money shouldn’t just stay in fixed deposits and real estate.”

Nithin Kamath

Zerodha’s focus has now shifted to encouraging people to educate themselves about the market structure, providing them with resources for the same. Better market knowledge allows for better investment from local sources, which will only help boost the amount of money in the ecosystem and further drive growth.