Sequoia Capital has raised $2.85 billion to invest in Indian and Southeast Asian startups. The venture capital firm will invest approximately $2 billion in Indian startups, with the dedicated $850 million going to Southeast Asian startups. This is the largest fund of any kind by an investor in the region.

“This fundraise, which comes at a time when markets are starting to cool after a very long bull run, signals our deep commitment to the region and the faith our Limited Partners have in the long-term growth story of India and Southeast Asia.”

It further wrote, “Today we are pleased to announce the launch of our first dedicated SEA fund, Sequoia SEA Fund I, an $850 million corpus that we will use to partner with the next generation of founders on a mission to build enduring companies from the region. The new funds will bolster our mission to help daring founders to build legendary companies from idea to IPO and beyond.”

As detailed out in the post, Sequoia Southeast Asia will continue to invest actively in companies across the region at Seed, Series A, and growth stages with the new fund. The new funds follow a successful investment for the 50-year-old venture firm in India, where it began investing 16 years ago. The firm, which has 11 managing directors in the region, has seen nine of its portfolio startups go public in the last 18 months, including Freshworks, GoJek, and Truecaller, which was unheard of until two years ago.

Investments in India

Sequoia has been present in India for the past sixteen years and in Southeast Asia for ten years. “The firm has partnered with more than 400 startups across multiple sectors, stages and market cycles and has 36 unicorns in its portfolio.” The statement said that between 2021-2022, the VC firm saw nine IPOs, with notable ones like Freshworks and Zomato.

It has invested in over 400 startups in India and Southeast Asia so far, with 36 valued at more than $1 billion, including Byju’s, 1mg, Bira, Blinkit (formerly Grofers), Cars24, Meesho, and Freshworks. Thirteen new companies have gone public. Globally, the investor was an early supporter of technology megacorporations Google, Apple, and WhatsApp.

The Surge programme began three years ago and has grown to 112 startups operating in over a dozen industries. In addition, Sequoia is an investor in roughly three dozen of India’s unicorn startups. Through innovations such as the Scout program, and Surge, they have pushed the boundaries of the venture capital model and expanded capital access to founders.

“Sequoia pioneered the modern venture firm exactly 50 years ago. Since then, it has consistently innovated to remain in the top ranks of venture firms globally across geographies.”

Sajith Pai, an investor at Blume Ventures

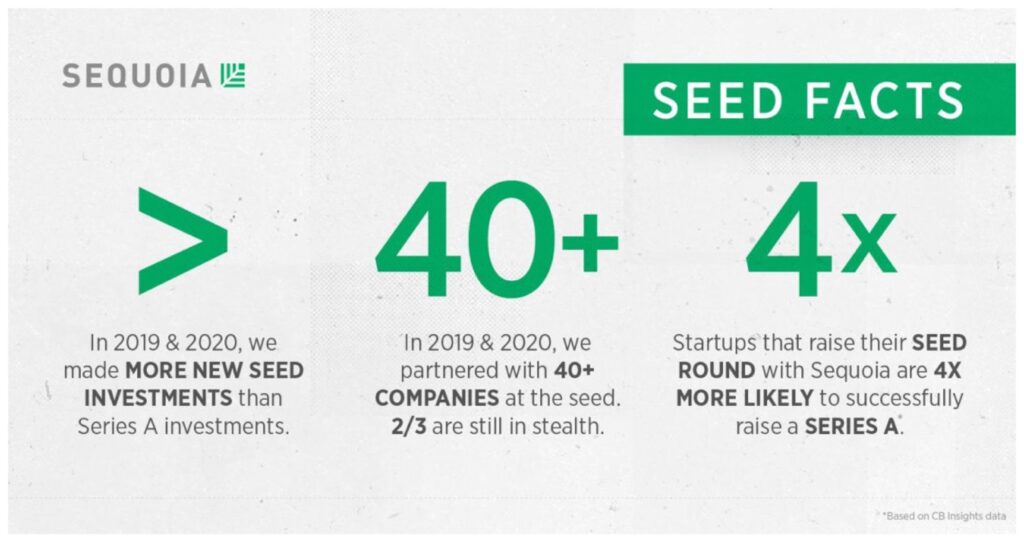

Sequoia’s new model follows two years of Sequoia’s $1.35 billion (approximately Rs 10,030 crore) as a venture and growth fund for India and SEA, which was announced in July 2020. In March of last year, it closed a $195 million (Rs 1,419 crore) seed fund for the two regions.

Sequoia India and Southeast Asia now manage over $9 billion in assets. The firm intends to invest nearly $300 million in early-stage startups and to “double down” on the region, where it runs programmes such as Surge, which backs very early-stage firms, and Spark, which offers fellowships to female founders in addition to venture and growth investments.